Renewed Confidence in Toronto Real Estate Market

What is Driving the Market in Early 2024?

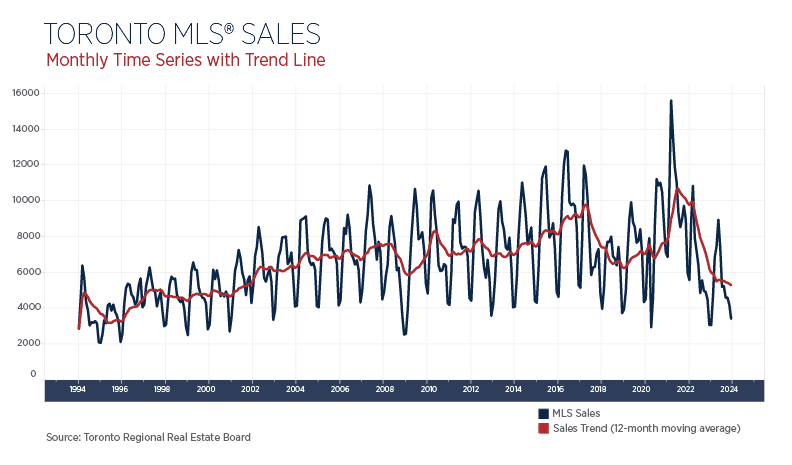

The media in January has been filled with headlines of buyers re-entering the market and multiple offers abound. January has demonstrated a sudden shift in consumer sentiment towards the real estate market, but why the sudden optimism?

The media in January has been filled with headlines of buyers re-entering the market and multiple offers abound. January has demonstrated a sudden shift in consumer sentiment towards the real estate market, but why the sudden optimism?

As is often said, “listen not to what one says but watch what one does.” And even though the Bank of Canada’s messaging at the end of 2023 was cryptic at times, it was widely believed among economic circles that the BOC may have overshot up to 50 basis points above where they should be. Then in January, we had another rate hold with discussions being that of “when” rates will drop instead of “if”. The reality is that fixed-rate mortgages have already begun to drop, and pre-approvals are on the rise as a result.

Naturally, consumers are therefore of the belief that the worst is behind us, and there is fuel for renewed confidence in the future. Now, add the current exceptional spring-like

weather in the GTA; it feels like now is the time to start the real estate process.

What Types of Real Estate will be the Most Attractive in the Early Part of 2024?

The Toronto freehold market will outperform the condominium market in the early months of 2024. Freehold properties will include freehold townhomes, semi-detached, and detached homes.

December is traditionally a slower real estate month, and it’s common to witness an inventory jump in January. The resale condo market is just a short step behind as this is the affordable entry point. At 4.8 months of supply, only the condo market has trended in balanced territory. I don’t anticipate this will be the case for long. The current inventory is not enough to fulfill the needs of many new buyers and the buyers that were already on the sidelines. Many buyers now believe that the opportunity to enter the real estate market is now in anticipation of affordability decreasing in the months ahead.

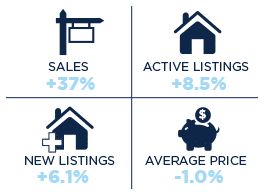

source: Toronto Regional Real Estate Board

The segment that’s heated up and will continue to be tight is the rental market. Landlords with increased borrowing costs quickly realized that prospective tenants were unwilling to accept asking rates and adjusted the asking price. With the months of inventory now at 1.6, as borrowing costs drop, the rental market will experience a frenzy moving forward.

In our next market report, we will not only discuss the resale market but also share insights into the pre-construction market.