SALES COMMENTARY

While overall home sales across the GTA slowed slightly this June, detached houses continue to pull their weight—making nearly half of all transactions.

While overall home sales across the GTA slowed slightly this June, detached houses continue to pull their weight—making nearly half of all transactions.

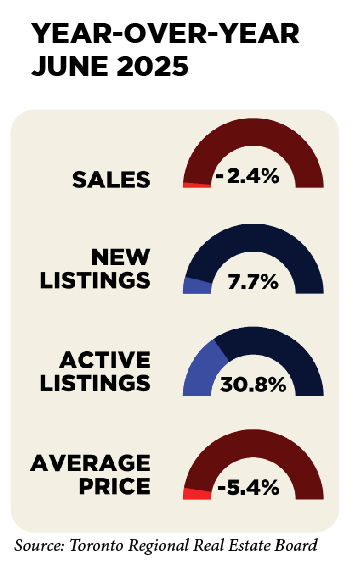

According to the Toronto Regional Real Estate Board (TRREB), 6,243 home sales through the MLS® System in June 2025—a modest 2.4% decline compared to June 2024. Meanwhile, new listings rose 7.7% year-over-year, reaching 19,839, giving buyers more options and a bit of breathing room.

June’s numbers show the overall market trends, but they don’t highlight the differences between condos and freeholds

Condos Summary

For condos, supply rose to 7.1 months, while average prices declined 6.4% year-over-year to $683,413—the lowest we’ve seen in four years. Over the past three years, average condo prices have fallen by a total of 12.0%.

Condo resale prices continue to face downward pressure. That said, there’s a bit of a bright spot: two-bedroom units are getting more attention, and rental prices have started to stabilize. But small investor-style condos are still struggling the most, with lower demand and tighter returns.

DETACHED HOMES

First-time buyers have emerged as a key force in the detached market this year. With prices ticking up in May, many jumped in before they get priced out entirely. Homes in the $850K–$1.2M range—especially in well-known neighbourhoods—are seeing strong activity, even multiple offers. In Toronto’s core, homes in this range sold in an average of just 19 days during the first half of 2025, outpacing most other segments.

There’s also healthy movement in the $1.8M–$2.2M range, particularly in family-oriented, established communities.

As summer progresses, signs point to a long-awaited spring market finally taking shape. Activity has picked up with more listing views, showings, and offers—yet buyer psychology remains cautious. Today’s buyers are strategic: they will walk away from a deal if pricing lacks justification. Sellers, meanwhile, are either standing firm or—in more urgent situations—resetting pricing benchmarks in their neighbourhoods. This push-and-pull is keeping things balanced… for now. If interest rates drop again later this summer, we could see pent-up demand really take off.

THE LUXURY MARKET

The entry-level luxury segment, defined as homes priced between $2.8 million and $3.3 million, has experienced the greatest slowdown, with elevated inventory and limited sales. In contrast, the upper luxury market—ranging from $3.8 million to $4 million—has proven more resilient. These purchases tend to be lifestyle-driven, less dependent on borrowing costs or timing.

The GTA housing market is still in recovery, but not all segments are moving at the same pace. Trends vary widely depending on price point and neighbourhood. As factors like interest rate cuts and overall economic confidence shift later this summer and into fall, we could see a change in momentum. If that happens, pent-up demand may finally start to flow, leading to a more balanced and active market in the months ahead.