Resale Freehold Market

The Greater Toronto market continued to navigate through uncertainty in April, largely due to anticipation surrounding the federal election. Political tensions and trade uncertainties dominated headlines and captured national attention.

The Greater Toronto market continued to navigate through uncertainty in April, largely due to anticipation surrounding the federal election. Political tensions and trade uncertainties dominated headlines and captured national attention.

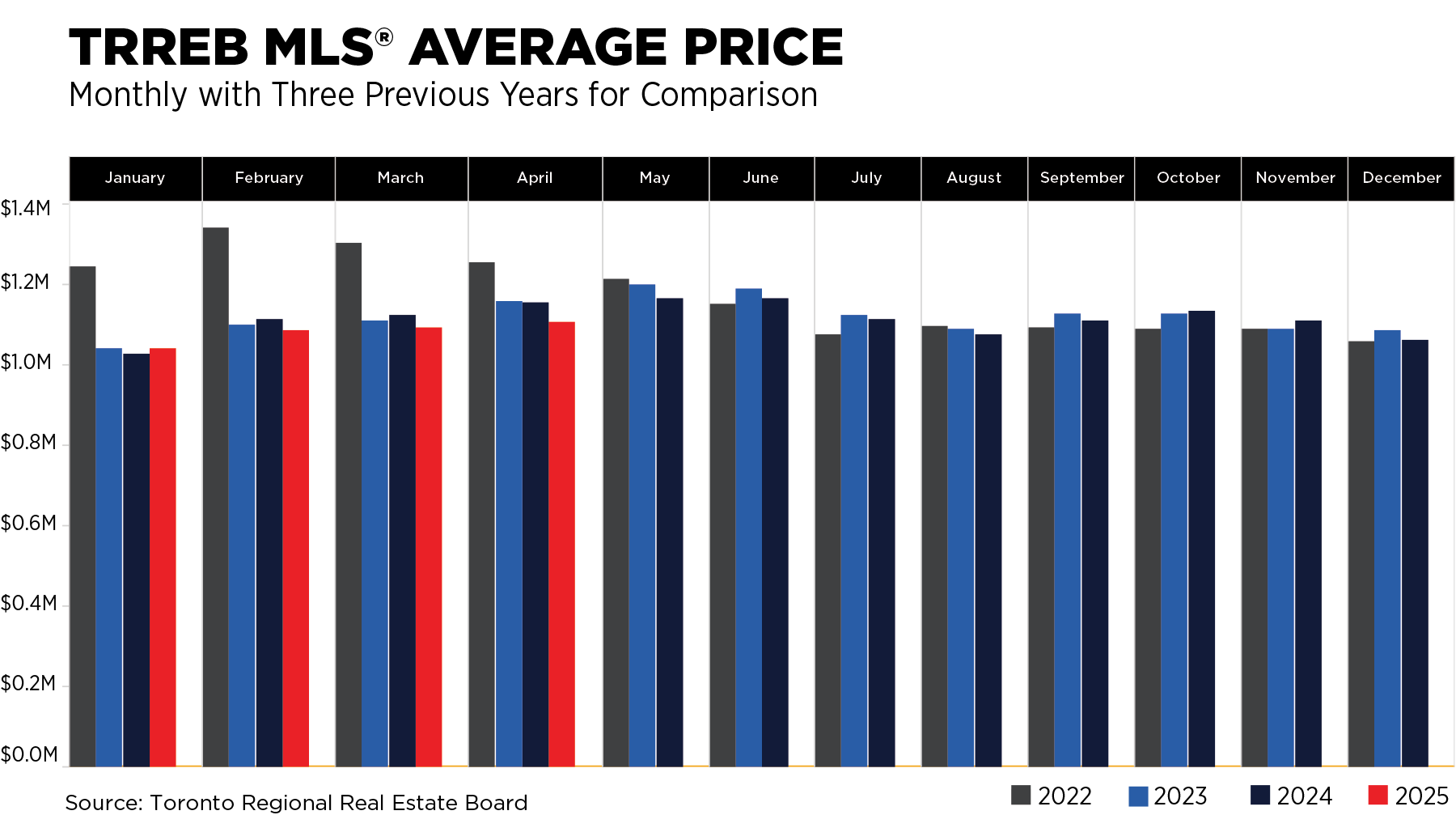

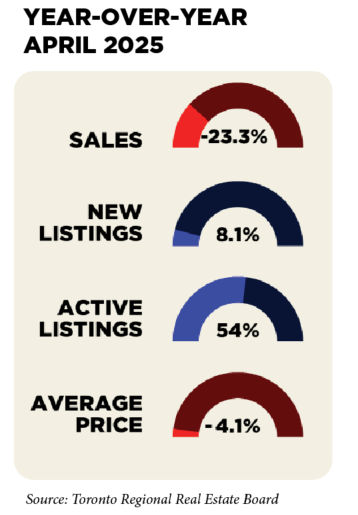

GTA REALTORS® reported 5,601 home sales through TRREB’s MLS® System in April 2025 — a 23.3% decrease compared to April 2024. However, new listings reached 18,836, reflecting an 8.1% year-over-year increase.

The average selling price was $1,107,463 — down 4.1% from April 2024. On a month-over-month, seasonally adjusted basis, the average price also declined. Based on current activity, annual home sales are projected to reach approximately 56,000 transactions.

Sellers who are not adjusting to the new value environment appear to be chasing the market or deciding to place their plan on hold. Following the election, the market showed signs of renewed momentum, with increases in activity on listings with showings, and offers. Anticipated interest rate cuts — with two more expected this year — are likely to support a more optimistic outlook for both buyers and sellers.

This is clearly a buyer's market mindset, where affordability remains the primary concern to considering homeownership. However, the evolving landscape is creating opportunities for the well-informed buyers. As trade tensions ease, stronger market absorption is expected in the months ahead.

New Condominium Market

Developers are heavily relying on incentives to drive sales, including substantial cash-back credits at closing ranging from $10,000 to $100,000, temporary price reductions, rental guarantees, and extended deposit payment schedules.

Unsold new condominium inventory totalled 23,908 units in Q1 2025 — up 6% from a year earlier and 58% above the 10-year average. The average selling price for new condos was $1,151 per square foot, representing a 7% year-over-year decline.

Condo completions are projected to hit 31,404 units in 2025, surpassing the record of 29,671 units in 2024. However, completions are expected to drop to 19,410 units in 2026.

Resale Condominium Market

Inventory remained elevated, with 6.2 months of supply — more than three times the 10-year average of 2.0 months. The average resale condo price in April was $682,019, marking a 2.6% annual decline and the third consecutive year of price reductions.

Prices are now 15.7% below the 2022 peak of $808,921 and only 3.5% higher than they were in April 2020 ($659,228), underscoring a prolonged correction in the resale condo segment.

Condominium Rental Market

Increased completions added a substantial number of units to the rental market, exerting additional downward pressure on rents. Average rents declined by 4.2% year-over-year — consistent with recent monthly trends.

Active condo rental listings rose 30% from a year ago, reaching 6,385 units. Despite this, the months of supply metric remained unchanged at 1.4 months, still above the long-term average of 1.0 month.